While we are independent, the offers that appear on this site are from companies from which receives compensation. and changed its name to RAPT Therapeutics, Inc.į is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. The company was formerly known as FLX Bio, Inc.

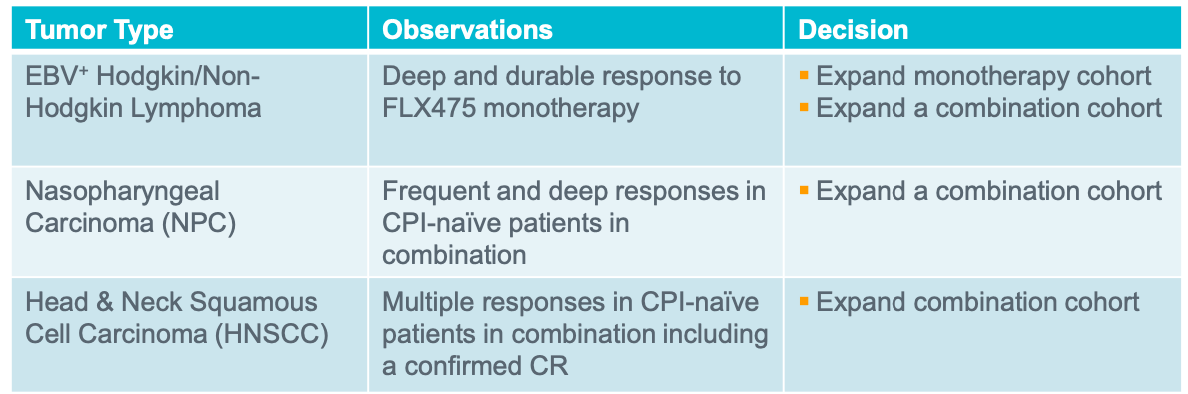

It is also pursuing a range of targets, including general control nonderepressible 2 and hematopoietic progenitor kinase 1 that are in the discovery stage of development. The company's lead inflammation drug candidate is RPT193 to selectively inhibit the migration of type 2 T helper cells into inflamed tissues. Its lead oncology drug candidate is FLX475, an oral small molecule C-C motif chemokine receptor 4 antagonist that is in the Phase 1/2 clinical trial to investigate as a monotherapy and in combination with pembrolizumab in patients with advanced cancer. , a clinical-stage immunology-based biopharmaceutical company, focuses on discovering, developing, and commercializing oral small molecule therapies for patients with unmet needs in oncology and inflammatory diseases. This would suggest that RAPT Therapeutics's shares are less volatile than average (for this exchange). The market (NASDAQ average) beta is 1, while RAPT Therapeutics's is 0.1382.

A popular way to gauge a stock's volatility is its "beta".īeta is a measure of a share's volatility in relation to the market. Over the last 12 months, RAPT Therapeutics's shares have ranged in value from as little as $14.89 up to $43.26. We're not expecting RAPT Therapeutics to pay a dividend over the next 12 months. TTM: trailing 12 months RAPT Therapeutics share dividends Our pick for active traders.TradeStation is our top pick for this category because it offers a wealth of tools and data for active traders, along with paper trading and educational resources.Plus, there’s no minimum to open an account. SoFi also has financial advisers on staff to help talk you through trading strategies and financial goals - for free. We chose SoFi for this category because it offers commission-free stocks and an easy-to-use mobile app that’s highly-rated by customers. It’s a unique option best suited to investors who want some control over their portfolio, but aren’t experienced enough or don’t have the time to actively manage a portfolio. M1 is our pick because it lets you choose your own stocks, but offers automated portfolio rebalancing to manage your risk level. We encourage you to compare stock platforms to find one that's best for your particular budget and goals. We evaluate stock trading platforms against a range of metrics that include fees, ease of use, available securities and advanced tools to meet specific investor needs.

0 kommentar(er)

0 kommentar(er)